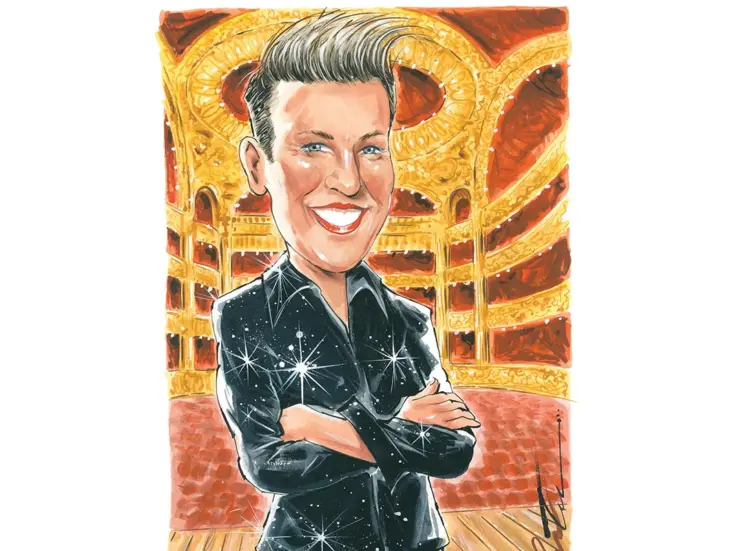

Andrew Ross Sorkin is the wunderkind behind Too Big to Fail, the minute-by-minute account of Wall Street’s collapse in 2008 and winner of the Spear’s Financial Book of the Year Award. Josh Spero discovers whether he’ll be writing a sequel and who’ll be starring in the movie

TWO NEGATIVES MAKE a positive, right? So lots of failures can still make lots of successes? This has to be true, otherwise we are at a loss to understand the continued existence of the Western financial system and its grim determination to fail in every conceivable capacity. The key is ‘too big to fail’: the bigger the heap of negatives, the more positives you have to try and derive from it.

The Thucydides of this crisis is Andrew Ross Sorkin, only with a blog and an office near Wall Street. A boy wonder who filed dozens of articles for the New York Times before he left college, he is now – aged 33 – the chief M&A reporter for the paper and founder-editor of Dealbook, its financial blog. He has come to London to promote Too Big to Fail (winner of Financial Book of the Year at the Spear’s Book Awards 2010), his minute-by-minute, thrillingly cinematic account of the turmoil that shattered Wall Street.

Through 600 pages, he delves into the boardrooms and brains of all the key players, many of whom gave interviews, in a rat-a-tat-tat sequence of scenes, shifting practically every page from Dick Fuld’s limo to Jamie Dimon’s office to the Lehman Brothers boardroom where the board finally vote to put the company into bankruptcy.

So novelistic is the book at points, with an omniscient narrator, that credibility does start to strain: how much is supposition and likelihood and embellishment? ‘I will tell you in all candidness,’ he says, ‘I wish it was novelistic embellishment. To get that detail you have to go through the wringer.’ He would take menus to interviews to prompt memories of what people ate; his researchers dug up hour-by-hour weather records, to bring to mind sticky undershirts and industrial air-conditioning. This level of detail – and the bodies strewn across boardrooms by the end of the book – is fit for CSI: Wall Street.

Take this extract, for drama:

Felder was talking so fast that it sounded as if he were hyperventilating.

“You have to call your cousin,” he insisted. “If there was ever a time to call the president, now is the time.”

Walker, a second cousin to President Bush, was hesitant about using his family connections.

“I don’t know,” he said.

“You’ve got to do it, George,” Felder said to him. “The whole fucking firm is going down. Someone’s got to stop this!”

Of course, no-one did stop this.

STILL, FORCING PEOPLE to recall whether they had the steak or the fish hasn’t led to any greater cognitive associations in the minds of the financiers. Too big to fail, perhaps, but surely not my fault? ‘They are still in denial. They talk about themselves as “survivors”, almost in the way a cancer survivor would – and without any sense of their role in creating the crisis. I think that’s very troubling.’

That is not to say they are without interest; Sorkin says, with some degree of pride, that industry leaders have read his book to learn what was happening outside their own silo. Despite what he describes as ‘an almost incestuous world’, clearly little communication among suspicious, jealous, secretive, competitive CEOs went on.

Sorkin, who is pale and clean-cut and has preternaturally wide eyes, drops in that they’re making a movie of Too Big to Fail, which seems perfect for Hollywood, a town where hubris is served along with the bread-basket at power lunches. ‘Someone was suggesting John Malkovich for Dick Fuld’ – suitably psychotic – ‘and Richard Gere for Jamie Dimon.’

You might think that the success of Fail would go to Sorkin’s head, but he has a very realistic view of what the book reveals: the media’s inability to penetrate the reality of 2008. ‘The book is a case study in my failure as a journalist – and probably many others’ failure too. There is stuff in it that we didn’t know at the time, I wish we had known after Lehman and AIG had gone down that they were trying to merge them together; that TARP was created not in September but April.’

As he gets passionate, his voice breaks upwards in the way New York accents do. ‘We all have the sense that the invisible hand was still working, the sense that the free market was still going during the spring and summer, but in fact Hank Paulson is moving the chess pieces around. All of those things.’ 2008 must have been disorienting at first hand and distressing in retrospect, to learn that one knew so little. Has the veil been removed? ‘Oh yes.’ But he leaves the final judgment to history.

Switching between the instant gratification of blogging and the Tantric process of writing a 125,000-word book was hard for Sorkin: ‘When you’re sitting in your room, an office at home, till five in the morning often, there are times when you are by yourself and you honestly think it is you, your wife, your mother and a couple of other people who are going to read this thing.’

While this might seem like false modesty in such a widely-read and powerfully-friended journalist (Jamie Dimon and John Mack came to the book launch), the early-hours isolation of the long-distance writer rings true. ‘Some writers play the keyboard like a piano – it flows out of them. For me, it doesn’t. So I sit there and I hunt and I peck at my notes.’

FROM WHAT SORKIN has to say about the current economic crisis (for that it is), it seems like he may be writing Too Big to Fail 2 soon enough, given the dance of debt the PIGS, not to mention Eastern Europe and the American states, are doing. ‘To me, the most disconcerting part of it was that we thought “too big to fail” was all about financial institutions – and now we are talking about it in the context of entire countries. I think ultimately – and this may be a bad prediction – we’re going to see the EU splinter.’

He worries about undercapitalised banks and a lack of economic harmony across the continent. ‘I don’t want to write the sequel, but I am deathly afraid there will be a sequel of some sort. I don’t mean to be depressing, but I don’t see the light at the end of the tunnel at all.’

Any glimmer of light on Wall Street is sadly misplaced. His day job on the M&A beat has shown him that ‘deals have fallen off a cliff’, which is an accurate reflector of business confidence. Add to this the banks’ CEOs who refuse to lend (‘The old saw is that they say on Wall Street a banker will only give you an umbrella on a sunny day, right? To them it is raining right now’), even as they project hope, and it is not clear how the economy will enter a positive feedback cycle.

When we meet, Congress has just passed President Obama’s 2,300-page financial regulation bill, which bans banks from most proprietary trading, regulates the largest (above $50 billion) and provides for the winding-down of those collapsing. The snag is that much of the regulation has been left undefined; now the regulators themselves have to sort out their own rules.

Sorkin is chirpily suspicious: ‘Well to me, the great fallacy of this whole past year in terms of the reform effort is that, ultimately, somehow legislation is going to fix it. This is not to suggest that legislation is not important – I am a proponent of reform. The real people who are going to fix it are the regulators themselves. It really is a matter of how the rules are implemented and enforced, and arguably many of the rules that were on the book, the regulators didn’t use.’

Thanks to the ‘politics over policy’ of the late Clinton and Bush administrations, which led to a home-ownership-at-all-costs drive, supplied with low domestic interest rates and the cheap money of the East, the regulators failed, or were neutered, or asleep.

‘The problem with this crisis is that there are so many fathers: the regulators, the policy-makers, the central bankers.’ (Not to mention the regular bankers.) This means not just that it is a hydra to prevent a financial crisis from happening again but also that the public are still angry, displays of contrition and atonement from these fathers having variously been vapid, insincere or non-existent. ‘On that aspect, it feels like very little justice has been done.’

But Sorkin points out, without mischief (however much it might be warranted), that it was three and a half years before Ken Lay was indicted for his crimes at ENRON. Perhaps one of those CEOs who turned first to the index of Too Big to Fail may yet find themselves being measured for handcuffs.

Buy Too Big to Fail in the Spear’s/Amazon store

Photography by Brent Murray