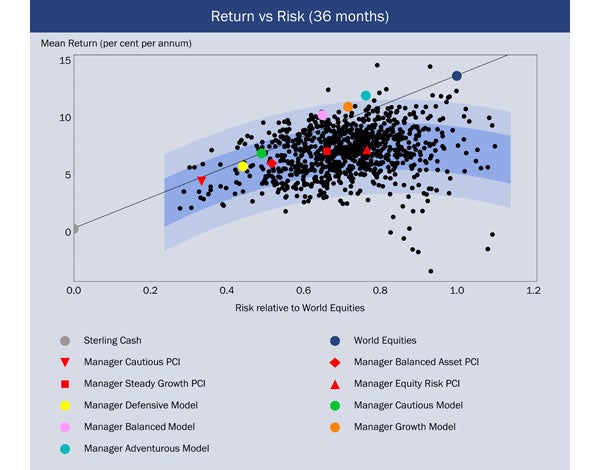

Above: An example of the way ARC can look at an investment manager’s performance

Established twenty years ago, Asset Risk Consultants (ARC) provides a range of investment advisory services from offices in London, Jersey, Guernsey and Toronto. Since 1995, ARC has helped wealthy individuals and families to organise their invest- ment affairs efficiently and to make the most of their involvement with the world of investment management.

To understand the way in which ARC can help a family of wealth with a complex set of requirements, there is no better example than that of Arthur Labatt, scion of the Labatt brewing empire. Arthur founded fund management company Trimark Investment Management, which he sold in 2000.

He quickly realised that the level of complexity in the modern investment arena makes investment decision-making a monumental task, even for someone as skilled and experienced as him. In 2003 he engaged ARC to over-see his investment interests.

Initially, ARC met with Arthur, his advisers and trustees and discussed his objectives, goals and other factors impacting on his investment strategy. ARC also set about determining his attitude to risk in relation to the money now at his disposal. Armed with this information, ARC set about finding the most appropriate mix of managers to handle his investments.

ARC began by carrying out a detailed audit of Arthur’s existing investment managers and from this, determined that one manager needed to be replaced. Working with Arthur and his other advisors, ARC narrowed down an initial long list of managers to a final panel for a beauty parade and ultimately Arthur chose one of these managers to replace the under achieving manager.

ARC then set about organising the new account, putting in place the appropriate agreements and mandates and negotiating fees. Due to the scale of its business, ARC has considerably more experience in these areas than even the wealthiest and most investment-aware clients and can generally negotiate more favourable terms on the clients’ behalf.

Once everything was in place, ARC settled into its ongoing role as investment consultant, coordinating regular reporting across all the investment managers used and producing aggregate reports for Arthur and his advisers. Over the years, ARC has identified moments where it was advisable to change a manager and, just as important, also identified moments when, despite apparent evidence to the contrary, the wise move was to continue with a manager.

In 2014 in a ringing endorsement of the quality of ARC’s Investment consultant service Arthur Labatt bought the business. A keystone of the ARC offering is its independence and under the ownership of the Arthur Labatt family office, this independence continues. A key driver for Arthur in investing into the ARC business was his strong belief that many more families around the world could benefit as he had done by involving ARC in their investment affairs.

ARC’s Investment Consulting service monitors and advises on over $12 billion of investment assets worldwide. Their clients range from large families to individuals, and the scope of work ranges from simple portfolio monitoring to complex multi-jurisdictional investment consulting, the unifying factor of all these clients is the recognition that working with an experienced independent investment consultant is something every private client should consider.

Contact: Matt Lonsdale,

head of business development:

matt.lonsdale@assetrisk.com

CHARTING A SMART COURSE

ARC has an unrivalled understanding of the various companies offering discretionary management services, and this knowledge forms the foundation of ARC’s manager selection process.

They have extensive amounts of proprietary data collected over many years; this includes a library of up to date due diligence questionnaires covering over 200 investment managers and analysis of the monthly performance data of over 150,000 individual client portfolios.

They use this performance data to produce quarterly peer group indices in four currencies across four levels of risk. This quantitative research allows them to observe portfolio performance data from a high level manager perspective or focused down to individual portfolios.

The chart above shows an example of the way ARC can look at an investment manager’s performance. The investment manager in this example is running five model portfolios for its clients (the coloured circles). The red shapes then show the average client performance, with the black dots representing individual client portfolios. It is clear that while the performance of the models is good, the outcomes for the clients are mixed.