Ten million is a small number these days. At least that’s according to a recent survey conducted by multi-family office Oracle Capital. 55 per cent of people consider wealthy only those who have £10 million or more and nearly a quarter only deem wealthy those with £100 million.

In contrast to the past, when the term ‘millionaire’ was a byword for considerable personal wealth, it is clear that our understanding of what it means to be wealthy has altered. A million in sterling simply no longer carries the heft that it used to.

Inflation, surging house prices and higher living costs are just a few factors that have pushed perceptions upscale, as has the increasing visibility of the ultra-rich.

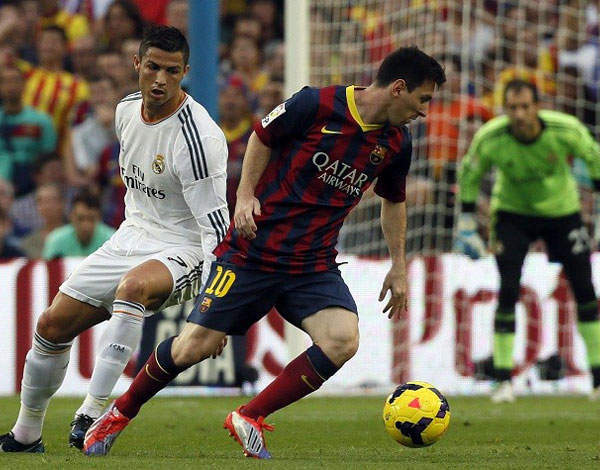

The results demonstrate the impact of the vast personal wealth accrued by many celebrities and other public figures. Two-thirds of those surveyed believe that the ubiquity of celebrities has skewed our perceptions of wealth, with almost half assigning this to sports stars.

A fifth of respondents said fortunes accrued in the media and arts had most altered their perceptions of wealth. 18 per cent pointed to the pay afforded to business executives and financial executives. 13 per cent of those surveyed felt that the wealth accumulated by the founders of tech upstarts such as Facebook, Twitter and Whatsapp was most responsible.

Yury Gantman, Oracle Capital Group’s CEO, said of the findings: ‘Clearly the idea of wealth is relative, but what is clear is that the word “millionaire” does not necessarily now conjure up the sense of significant wealth that it did until relatively recently; today, it’s more about being a “ten-millionaire”.

‘Many people who own properties in the London area have become millionaires by virtue of the dramatic inflation of house prices, but would not necessarily regard themselves as HNWs. This is undoubtedly a reflection of growing living costs which, alongside the housing market, have affected food prices, school fees, travel and other household outgoings, but also – as indicated by our survey – because their own personal assets are dwarfed by the immense and highly publicised fortunes of footballers, film stars, hedge fund managers and tech billionaires.’

Spear’s asked Gantman what psychological impact the findings may bring to bear on the HNW community. Would it make those who consider themselves wealthy feel inadequate?

‘Regardless of whether or not these findings dent the pride of those with less than £10 million, what is not in doubt is that the majority of people have recognised that inflation and sharp house price increases mean that having assets of £1 million no longer makes you stand out.’

(Pictured top: Cristiano Ronaldo has stepped into the shoes of David Beckham as the richest active footballer in the world)