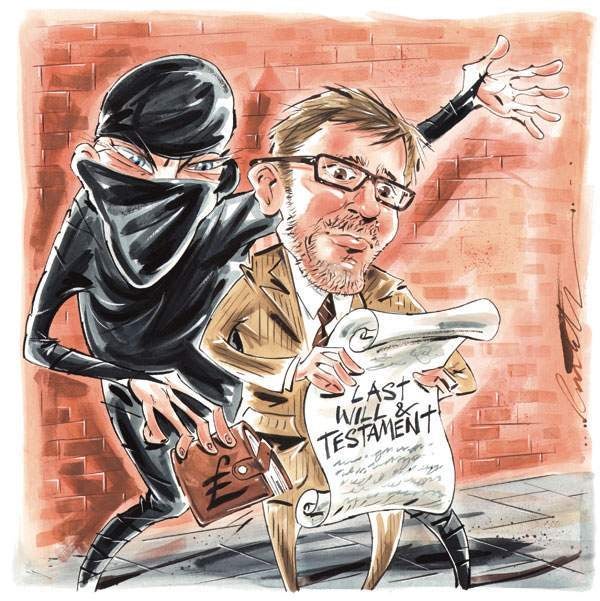

The government’s proposed changes to probate fees would be a bitter pill for many HNWs to swallow, say Jenny Cutts and Caroline Cook of Wedlake Bell.

Back in February the Ministry of Justice published a consultation paper with a view to reform fees for probate applications in England and Wales. The paper proposes a staggering top fee of £20,000 to issue Grants of Probate for estates of £2 million and above. The proposals had been met with widespread disbelief in the industry. What do the proposals mean for HNWs’ estate planning, and how do they compare to the current system?

The probate fee is paid when the executors of your will apply for a grant of probate. The grant provides your executors with proof of their authority to collect in your assets and administer your estate. It is produced for institutions with whom you hold assets (such as banks and investment managers). Your executors can then realise these assets and distribute them in accordance with the terms of your will. The current grant fee is £155 for applications made by solicitors and £215 for personal applications. There is no fee for estates worth £5,000 or less.

The government’s consultation paper proposes to replace the current fixed fees with a banded structure linked to the value of the deceased’s estate. Any estate worth £50,000 or more will pay significantly higher fees than under the present system, with estates exceeding £2 million facing an exorbitant increase of 12,900 per cent in the fees payable.

The government claims that the fee increases are justified to fund the modernisation of HM Courts & Tribunals Service and to help plug a deficit in funding. Fees imposed in other courts in England and Wales are also under review, but the proposed fees for these courts do not begin to approach the scale of fees imposed on the issue of a grant of probate. Colleagues and peers question whether it is fair or correct for the government to expect the Probate Registry, and your estate, to bear the burden of these costs.

An application for a grant is distinct from other court applications. Executors have no choice but to apply if they are to access the assets under your will. This is unlike other court applications, where there is an element of choice involved and the claiming party can make a commercial decision on whether to pursue a claim and pay the court fee. In some cases, a successful claimant will also be able to recover these fees from the other side.

In most cases, an application for a grant is an administrative process and the size of the estate has no bearing on the work involved. Even on the current fee rates, the Probate Registry is already self-funding. Bringing the courts service into the 21st century and balancing the books are admirable concepts, but it is impossible to see how increasing probate fees to a figure significantly in excess of fees in other courts can be justified. Nor is it easy to see how linking the fees to the size of your estate to create such an extreme difference in the fees payable can be appropriate when the work involved is the same whatever the figure.

The proposals are a bitter pill to swallow for estates which are already paying vast amounts of Inheritance Tax and already contribute to the system significantly on death. The government has also sought to justify its proposed probate fee increases on account of these concessions, stating that the Inheritance Tax cuts will outweigh the increased probate fee. This relates to the introduction of the ‘residence nil rate band’ for Inheritance Tax in the Summer Budget 2015.

The residence nil rate band introduces a £100,000 allowance in April 2017 (rising to £175,000 in 2020/21). Taken together with the current nil rate band of £325,000 it will give married couples and civil partners a potential combined allowance of £1 million by 2020/21; however, unlike the nil rate band, this relief is tapered and reduces to nil for those estates worth £2.2 million or over in 2017/18. Conditions are also attached; these conditions broadly mean that only individuals with children and grandchildren are capable of benefiting. HNWs are therefore unlikely to derive any benefit from this residence nil rate band but will still have to pay £20,000 for a grant of probate.

The proposed fee reforms have been criticised as a stealth tax and an easy way for the government to raise funds without the risk of damaging headlines that an increase in Inheritance Tax on estates would produce. A slight increase in Inheritance Tax to raise revenue would, however, be a transparent and open way to deal with revenue-raising. The risk otherwise is that families will not become aware of these fees until your death, when it will be too late to consider the funding options available.

How will families find this level of fee before assets in the estate are released? Executors will be placed in the invidious position where they have to find the probate fee and the Inheritance Tax before they have access to the estate’s assets. Although some asset holders can release funds to pay these liabilities directly before the grant is issued, in other cases there will be insufficient liquid assets available to settle these bills and executors have to take on a considerable amount of personal financial risk to raise these funds.

Increasing the probate fees to such an exorbitant amount only adds to this burden. For an estate worth £2,000,000.01, the executors will need to find 34.5 per cent of the value of the estate to cover the Inheritance Tax and the probate fee. This does not sit easily with the average estate only holding liquid assets of 25 per cent; in such cases, £190,000 will need to be found from somewhere before the grant can be issued. While bridging loans could be used, these are expensive in terms of interest, time, and the work involved. Raising these additional funds will delay the issue with the grant, and the ultimate distribution of the assets to the beneficiaries.

If the proposals go through, HNWs will have to factor the fee into their standard estate planning, ensuring that enough assets are held in liquid form (preferably jointly with their spouse, and partner or another trusted party) so that the fee can be paid without executors having to worry about funding the amount from their own pockets. Alternatively, HNWs may find that investing in assets that do not fall under the terms of their will becomes a more attractive proposition. With certain types of asset structures falling outside the scope of your estate, and with the potentially favourable tax benefits introduced for pensions in the April 2015 Budget, the government may well find that, if introduced, these fees will ultimately reduce its revenue intake as HNWs seek shelter from these fees and Inheritance Tax by investing in more complex asset vehicles.

Others may also want to consider passing on assets during their lifetimes with the aim of reducing their estates below the £2 million threshold to reduce these fees, and to gain access to the residence nil rate band. There are a number of gifting options that can be considered to make use of the Inheritance Tax exemptions and reliefs available. However, these options will not always be practicable or appropriate for everyone and come with their own risk.

The probate fee proposals represent a significant shift in approach and effectively another tax on wealth. Unfortunately, this is a way in which the government can require those who have more to pay more, without formally raising taxes and having to jump through the legislative hoops and deal with the bad publicity that this would entail. The fee increases are a step too far and the wide opposition raised will at least ensure that these reforms do not quietly find their way on to the statute book. The government needs to listen to the industry and will need exceptionally robust justification for going ahead.

Jenny Cutts is a partner and Caroline Cook is a senior associate in the Private Client Department of Wedlake Bell LLP