A report released by Close Brothers Asset Management has found that less than half of those exposed to inheritance tax (IHT) know the correct tax threshold, meaning loved ones can be subject to unexpected bills.

The report, entitled Heir Today, Gone Tomorrow, identifies causes for concern for both those hoping to leave and those hoping to receive inheritance: it suggests 32 per cent of people are oblivious to the need to plan an inheritance transition, while 43 per cent have not sought professional advice.

Read more on inheritance tax from Spear’s

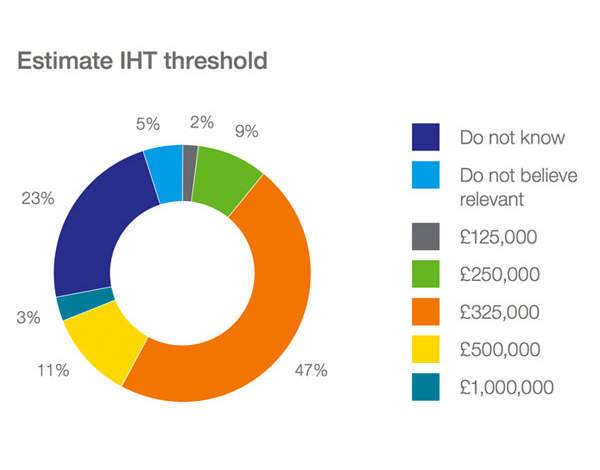

This is in conjunction with a broad level of ignorance; understandably, IHT is not breakfast table chatter. Only 47 per cent of those liable for inheritance tax on their personal assets know the correct threshold while 14 per cent wrongly assume the threshold is £500,000 or higher.

‘With £75 billion being inherited in the UK every two years, large sums of family wealth are left unnecessarily exposed to tax. A combination of planning inertia and a general lack of awareness is to blame, but it is crucial that those who will see their estates subject to the tax understand their liability,’ said Patrick Haines, regional head of advice at Close Brothers Asset Management.

Family wealth has rarely looked more precarious with house price inflation pushing more and more parties over the £325,000 threshold (which has been frozen until at least 2019); the number of Britons set to fall into the tax is forecast to double from 21,000 in 2012 to 42,000 by 2016/17. The amount paid in inheritance tax is predicted to climb by 60 per cent to £6 billion by 2019.

18 per cent of affluent respondents surveyed were unaware of the seven-year gift rule, which means gifts are not subject to IHT if you die more than seven years after making them, and two-thirds did not understand Business Property Relief, another legitimate tax-saving measure.

An increase in the number of individuals who might consider tax planning is clearly of interest to Close Brothers Asset Management and companies offering similar services. The report maps the numbers geographically as well as demographically, indicating those in the North and Scotland are much more likely to be aware of the IHT threshold, and how to avoid it, than those in Wales and London.

This suggests, if nothing else, a potential windfall for tax advisers in the capital where residents have the highest liability.